The student loan aid will benefit 125,000 borrowers, including 53,000 people who have worked in the public service for ten years or more.

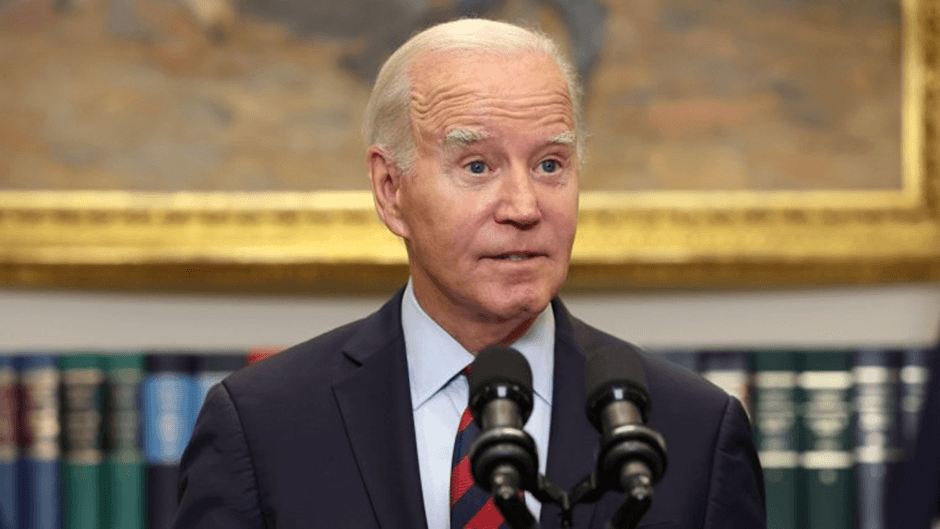

President Joe Biden announced this week that his administration has signed off on $9 billion in student loan forgiveness for 125,000 people in the United States. “It means millions of Americans can go and get their lives under control by freeing them from the burden of student debt,.” Biden said in a speech at the White House on Wednesday.

Here’s what you need to know about how the assistance program works and what it means for you.

Who can get help in Student Loan Aid

More than $5.2 billion in new loan relief will go to 53,000 borrowers in the State Loan Forgiveness Program, which includes people who have been in public service for ten years or more and have made 120 qualifying payments. (White says borrowers include those who work for federal, state, local or tribal governments, or for nonprofit groups.)

It will provide about $2.8 billion to about 51,000 borrowers enrolled in qualified income repayment plans. Who have made payments for at least 20 years but “never received relief,” the White House said. The remaining $1.2 billion will benefit 22,000 borrowers with “total or permanent” disabilities.

How can you sign up for Loan Relief?

Biden directs borrowers to StudentAid.gov/SAVE.

How much debt has been written off so far?

White said this week’s announcement means the Biden administration has forgiven about $127 billion in debt. For about 3.6 million borrowers, including about $42 billion for about 855,000 people eligible for income tax relief.

What about Biden’s original plan for Student loan aid?

The Supreme Court this summer struck down Biden’s student loan relief plan. This plan allowed nearly 43 million borrowers to eliminate debts of up to $20,000 each. The plan would cost the US government more than $400 billion, according to Congressional Budget Office estimates.

The Supreme Court followed an ideological line in a 6-3 vote, ruling in one of two cases that Biden’s program was an illegitimate exercise of presidential authority because Congress did not expressly approve it.

What else is on the table?

After the Biden administration’s Supreme Court loss, the president said he would look for other ways to deal with student debt, including the Higher Education Act of 1965. Biden said Wednesday that the act would allow the secretary of education to “compromise, eliminate.” or reduce debt under certain conditions. “

“Last week, the Department of Education took an important step in that process by identifying specific challenges facing borrowers in the current system,” Biden told reporters.

Are federal loan payments still pending?

Not. Tens of millions of Americans with federal student loans were forced to resume payments on Sunday. After a pandemic-era payment break ended.

Eligible borrowers received relief starting in March 2020, when President Donald Trump signed the CARES Act. The recess has been extended several times – twice by Trump, six times by Biden.

Who is dealing with student?

American students of color struggle to take out and pay off student loans at a higher rate than whites, according to a 2020 study. It’s the status quo that perpetuates the “vicious cycle” of racial economic inequality. According to a report from the Student Borrower Protection Center, a consumer protection group.